Do you want to send your Venmo account some money via your credit card? Read on for everything you need to know about Venmoing yourself from a credit card.

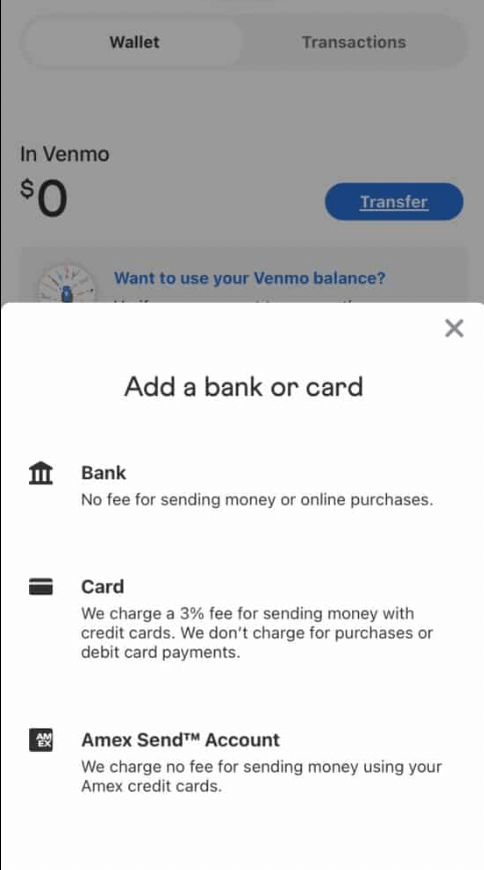

Yes, you can pay someone on Venmo with a credit card for a 3% fee. And depending on your provider, it either counts as a cash advance or a payment. To start, go to Payment Methods in Settings, select Add Bank or Card, fill in your Credit card details, and verify.

Sometimes, when we’re going through a drier month than usual, financially speaking, we still need to buy groceries, pay back our friends, go out for a fun night, or whatever else requires money.

These months are normal, and we often rely on our credit cards to make it through. But can you do it with Venmo?

READ: Can You Add a Credit Card to Venmo?

Can I Use a Credit Card on Venmo to Pay Someone?

Yes, you can add your credit card (which has a 3% fee) and use it on Venmo as you would with a debit card or directly through your bank account balance.

However, there are a few caveats to using a credit card on Venmo that don’t typically apply to debit cards or bank accounts. So keep reading as we’ll talk about those right away.

Credit Card Fees on Venmo

Unfortunately, there’s a 3% fee on your Venmo transactions funded with a credit card. The only ones that don’t incur a credit card fee are purchases made from authorized Venmo merchants.

In contrast, there are no fees to fund transactions with a debit card or bank account, meaning that using a credit card is the only method that costs extra to use.

How Does My Card Provider Register Venmo Funds?

When you fund a payment on Venmo through a credit card, it either counts as a purchase or a cash advance, depending on the standard set by your card provider.

So you should check with your card provider before using it on Venmo. This is because some providers even charge additional cash advance fees when you use your credit card to fund Venmo transactions, which are generally higher than purchase fees.

And these fees don’t show up on Venmo since they’re issued entirely by your card provider. And although it may sound like a small amount or percentage when you read about it, it can quickly add up.

Besides, you’ll probably have to pay back the cash advance in interest, which might not have a grace period. And all that might even increase your APR.

Overall, it’s vital to know how much using your credit card on Venmo will cost.

Can I Venmo Back to My Credit Card?

Any transaction between Venmo and credit cards is a one-way road. So while you can fund Venmo transactions through your credit card, you can’t do it the other way and transfer funds from your Venmo balance to a credit card.

RELATED READ: Can I Venmo Myself Money From a Credit Card?

How to Add a Credit Card to Venmo

Adding your credit card to Venmo is as simple as adding any other payment method, such as a debit card or bank account.

To add your credit card on your mobile phone, follow these steps:

- Open the Venmo app

- Click the blue person icon on the top

- Go to Settings from the top-right corner and select Payment Methods

- Select Add Bank or Card and choose Card

- Fill in your credit card information or scan it using your mobile camera

Is Using a Credit Card on Venmo Worth It?

Initially, the 3% fee and other potential credit card fees may sound like no biggie. But when you actually use your credit card on Venmo, these fees build up over time, and you’ll find yourself throwing a lot of money away.

For this reason, using a credit card on Venmo is hardly worth it if you have a better alternative readily available.

Otherwise, we understand if you need to use your credit card to fund your Venmo transactions. However, we recommend you look up how your provider handles Venmo transactions and calculate how much you’ll be paying in fees.

Also, try to keep your spending as low as possible.

Possible Alternative – Venmo Credit Card

An interesting alternative to Venmoing yourself with a credit card is to use a Venmo credit card. By doing so, you’re skipping the middleman (your credit card provider) and reaping the benefits right away.

Venmo’s Visa credit cards were announced just over a year ago in October 2020, and they provide the benefits of a regular credit card. In addition, they can be used on Venmo without incurring exorbitant fees.

Moreover, they automatically link to your Venmo balance, so there are no extra steps to use them on Venmo.

The only fee you’ll pay with a Venmo credit card is a cash advance fee, which is either 5% of the amount or $10 upfront, whichever is greater.

So, if you plan to use a credit card frequently on Venmo, you might want to opt for Venmo’s Visa credit card due to its benefits, including a fantastic cashback program.

Cashback Program

Venmo classifies your spending into several predefined categories, including travel, groceries, entertainment, dining, and bills.

At the end of your credit card billing cycle, Venmo gives you back 3% of your spending in your top category, 2% of the second, and 1% of the third. This could add up to a nice amount over time, especially if you’re going to use your card frequently.

Final Words

You absolutely can pay Venmo with a credit card. However, the question is if it’s really worth it, given the 3% transaction fee, cash advance fee, and potential APR raise you might get.

In our opinion, credit cards are only worth it on Venmo if you have no other option. And even then, you should keep your spending at the minimum to avoid incurring too many fees.